VDF NewAge

Internal Insurance Platform for Volkswagen Finans

Project Overview

VDF NewAge is an internal B2B insurance platform used by Volkswagen Dogus Finans sales and operations teams. The system supports complex insurance processes under regulatory constraints, covering customer management, policy creation, payments, and operational tracking.

Process Context

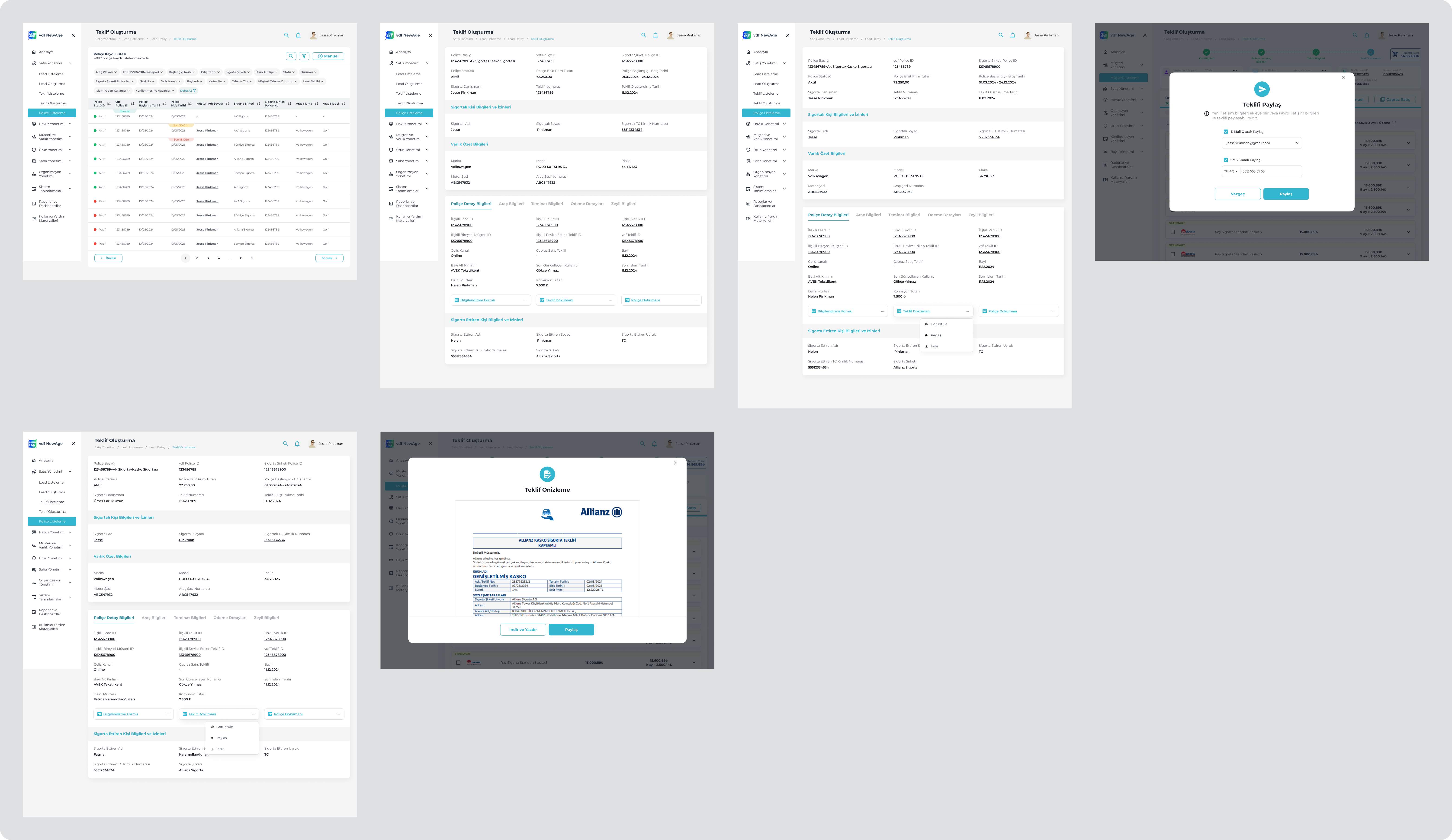

From lead creation to policy issuance, the product follows a multi-stage lifecycle. At a system level, this lifecycle is represented through a progress-based structure, enabling agents to track advancement across Lead, Offer, and Policy stages at a glance.

Lead

Initial customer contact and qualification

Offer

Policy configuration and proposal creation

Policy

Issuance, payment, and operational tracking

This approach improves follow-up clarity and cross-team alignment.

Detailed Lead and Offer management interfaces were designed by other teams and are outside the scope of my contribution.

Scope of My Work

My contribution focused on areas where operational complexity and error risk are highest.

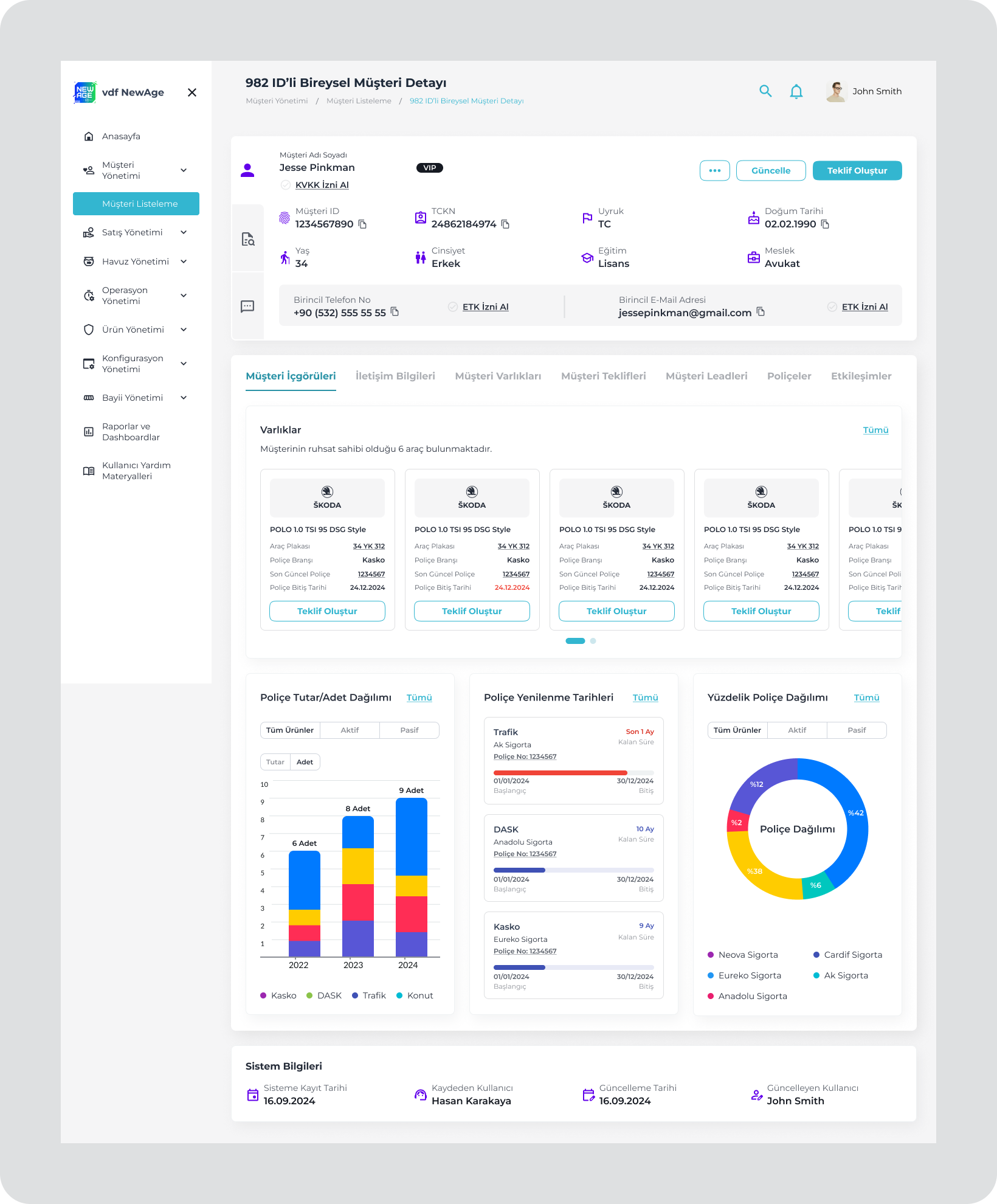

Customer 360 Experience

A unified Customer 360 view was designed as a single source of truth, bringing together all customer-related data.

This reduced context switching and supported faster, more confident decision-making.

Customer 360 - Unified Customer Detail View

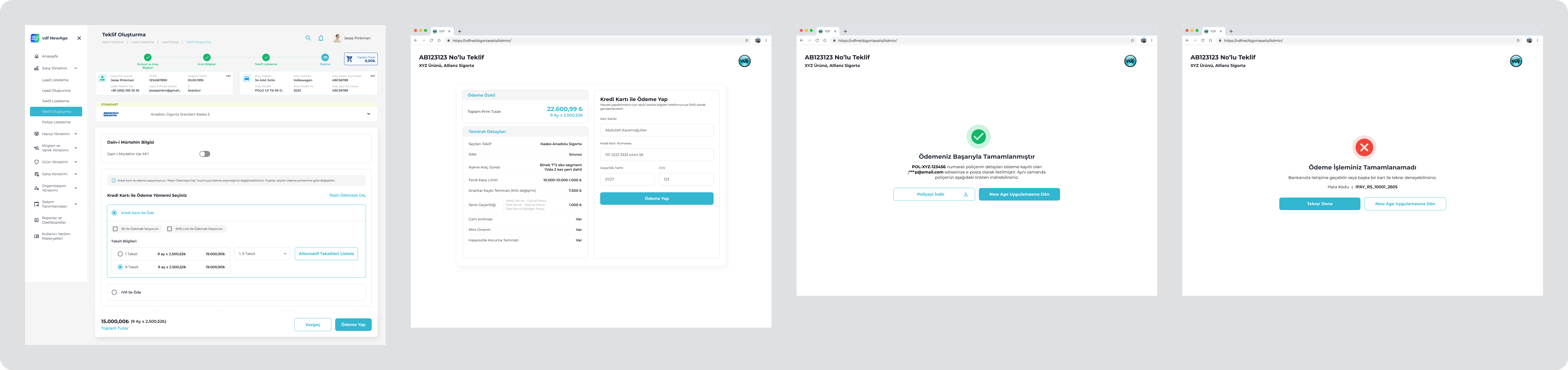

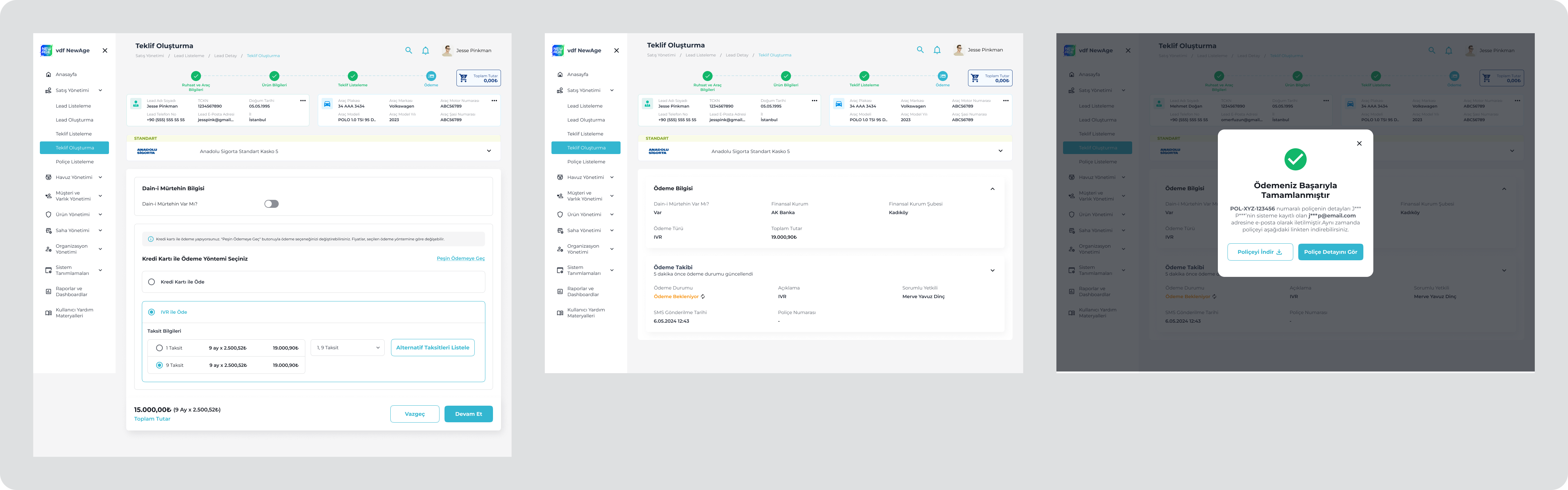

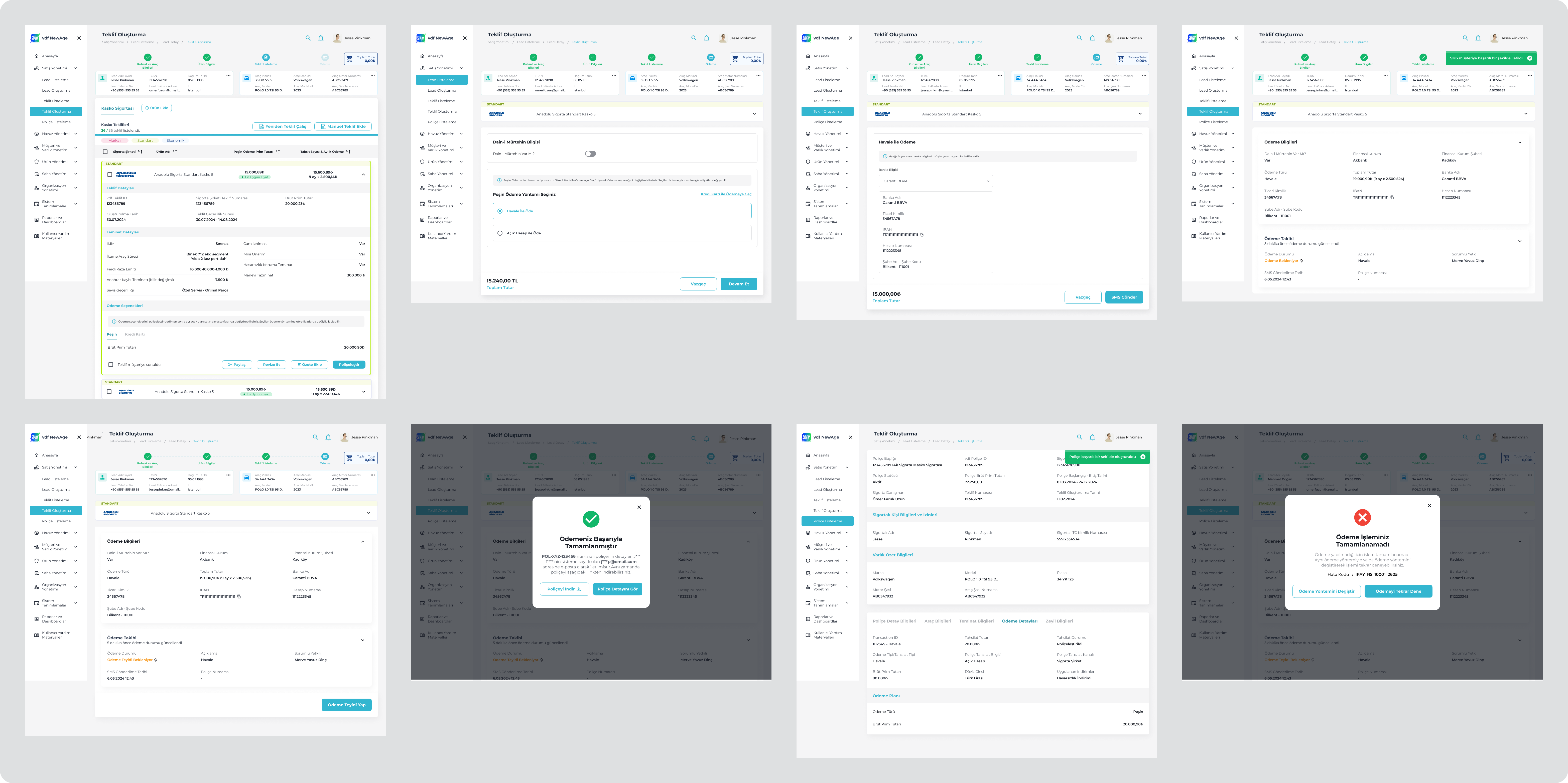

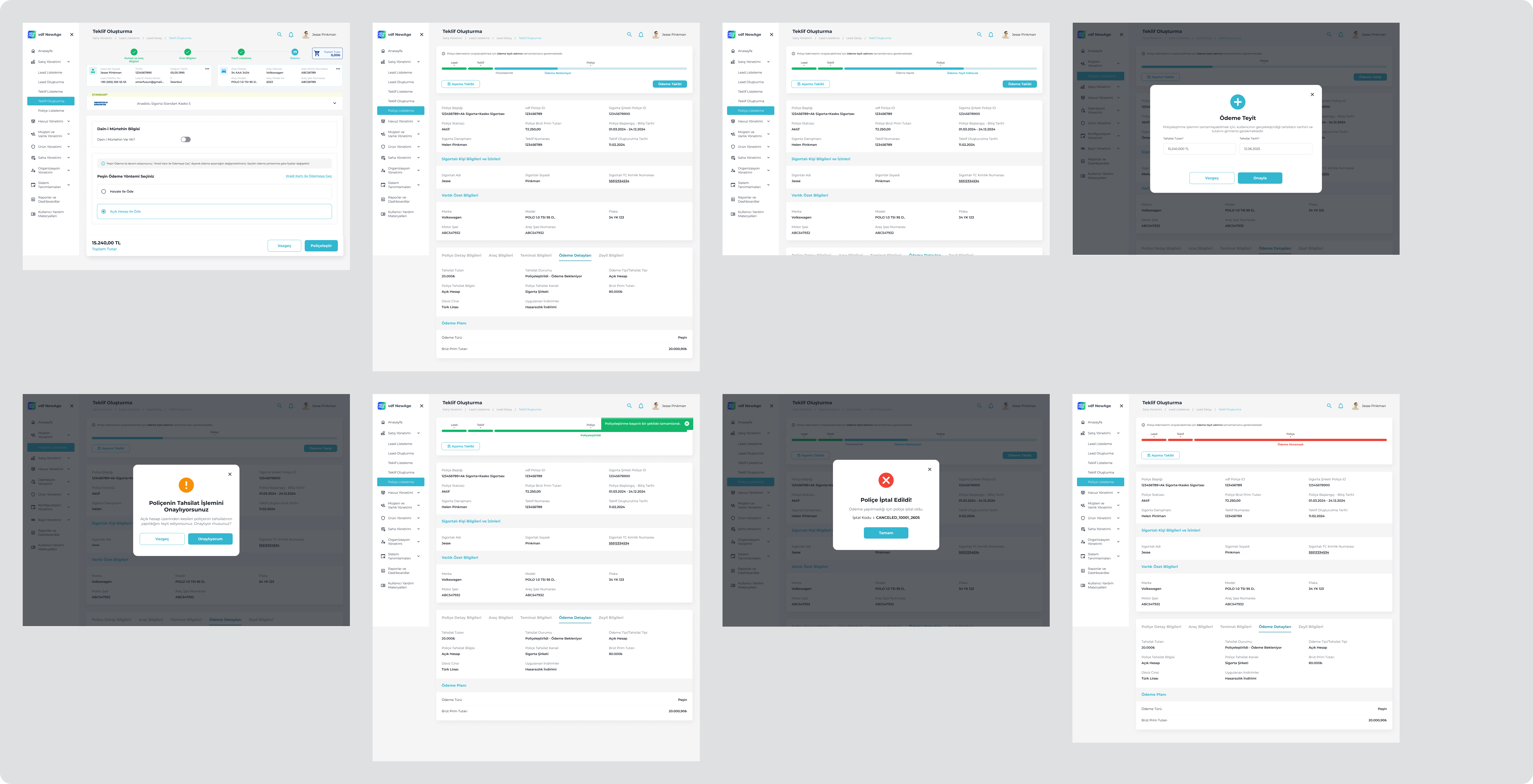

Policy & Payment Management

Policy-related experiences were designed to clearly separate commercial approval from operational and financial completion.

Payment Scenarios

Status-Based Design

Each scenario includes explicit pending, success, and failure states to prevent ambiguity in operational workflows.

Credit Card Payment Flow

IVR Payment Flow

Bank Transfer (EFT) Payment Flow

Open Account Payment Flow

View Policy Details & Documents

Coverage & Guarantee Mapping

Coverage and guarantee structures were designed to be explicit, reusable, and scalable.

Clear Relationships

Clear coverage-policy relationships to reduce confusion in complex insurance structures.

Rule-Based Configurations

Structured rule-based configurations that support operational consistency across teams.

Reduced Dependencies

Reduced dependency on agent memory or experience, enabling faster onboarding of new team members.